Utah Sales Tax Calculator

Utah Sales Tax Calculator - SalesTaxHandbook

Utah Sales Tax Calculator You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Amount Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/utah/calculator

Utah Sales Tax Calculator - Tax-Rates.org

The Tax-Rates.org Utah Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Utah. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Utah, local counties, cities, and special taxation districts.

https://www.tax-rates.org/utah/sales-tax-calculator

Utah Sales Tax | Calculator and Local Rates | 2021 - Wise

Local tax rates in Utah range from 0% to 4%, making the sales tax range in Utah 4.7% to 8.7%. Find your Utah combined state and local tax rate. Utah sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. That’s why we came up with this handy Utah sales tax calculator.

https://wise.com/us/business/sales-tax/utah

Sales & Use Tax - Utah State Tax Commission

Tax rates are also available online at Utah Sales & Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800-662-4335. Tax rates may change quarterly. Are transportation or delivery charges in connection with the sale of goods taxable?

https://tax.utah.gov/sales

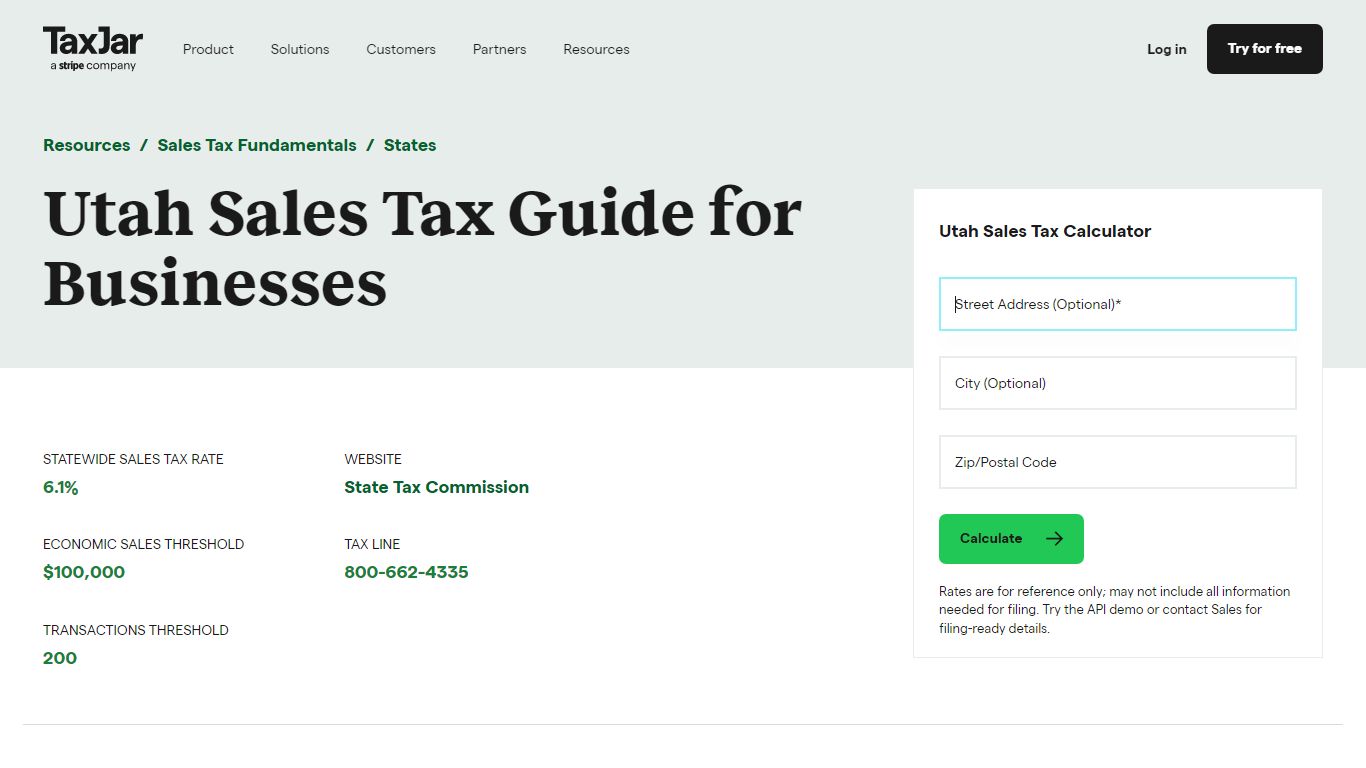

Utah Sales Tax Guide and Calculator 2022 - TaxJar

This means you should be charging Utah customers the sales tax rate for where your business is located. That rate could include a combination of state, county, city, and district tax rates. The state sales tax rate is 4.85%. To look up local sales tax rates (including Salt Lake City) by address and zip code, use TaxJar’s sales tax calculator.

https://www.taxjar.com/sales-tax/utah

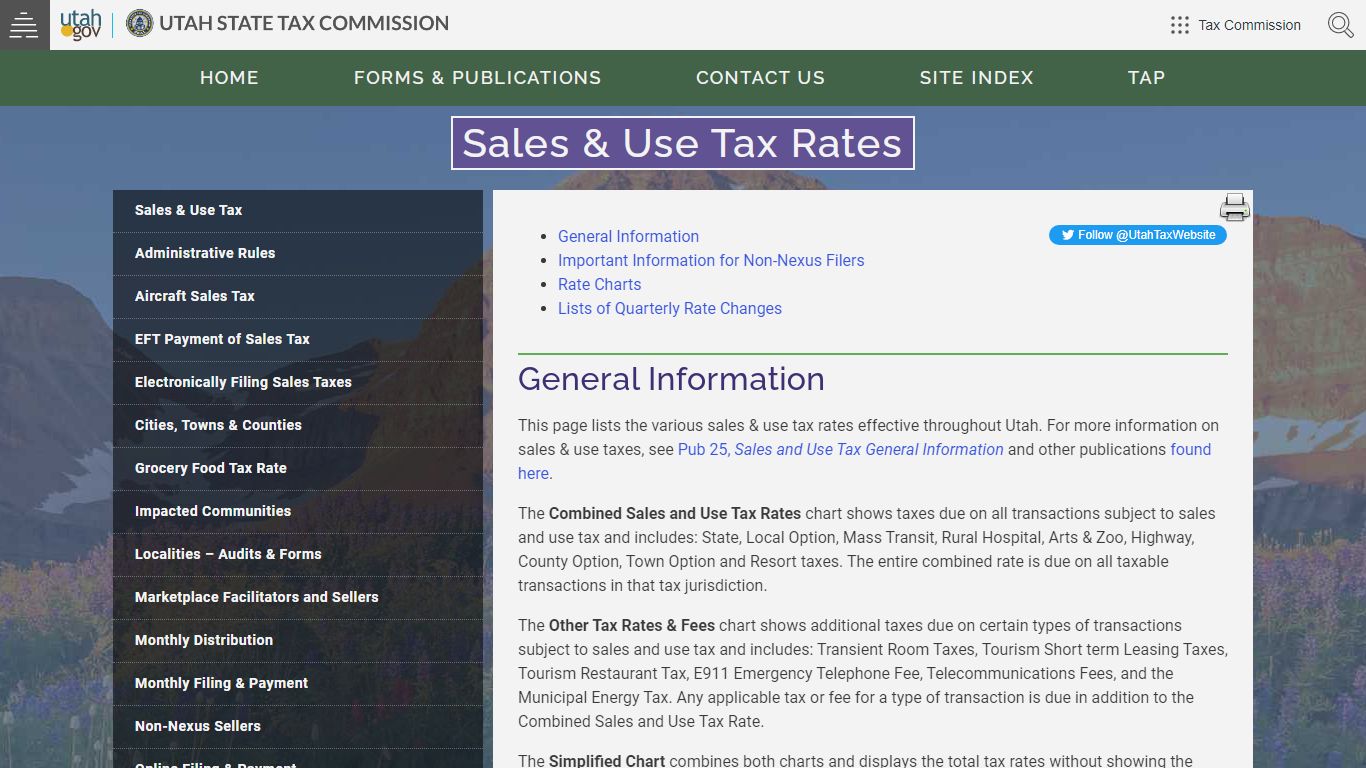

Sales & Use Tax Rates - Utah State Tax Commission

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes: State, Local Option, Mass Transit, Rural Hospital, Arts & Zoo, Highway, County Option, Town Option and Resort taxes. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

https://tax.utah.gov/sales/rates

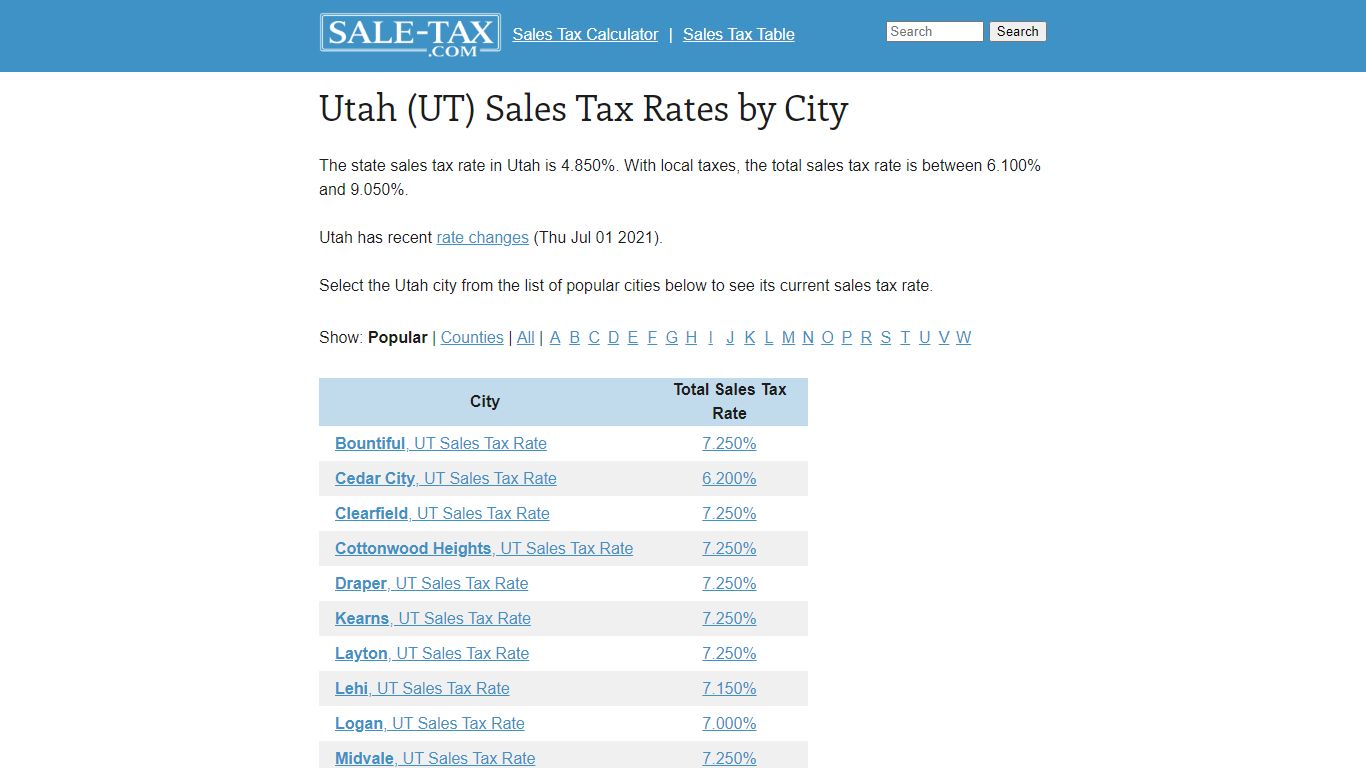

Utah (UT) Sales Tax Rates by City - Sale-tax.com

Utah (UT) Sales Tax Rates by City The state sales tax rate in Utah is 4.850%. With local taxes, the total sales tax rate is between 6.100% and 9.050%. Utah has recent rate changes (Thu Jul 01 2021). Select the Utah city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/Utah

Salt Lake City, Utah Sales Tax Calculator (2022) - Investomatica

Salt Lake City, Utah Sales Tax Calculator 7.6% Average Sales Tax For Salt Lake City, Utah Summary The average cumulative sales tax rate in Salt Lake City, Utah is 7.6%. This includes the sales tax rates on the state, county, city, and special levels. Salt Lake City is located within Salt Lake County, Utah.

https://investomatica.com/sales-tax/united-states/utah/salt-lake-city

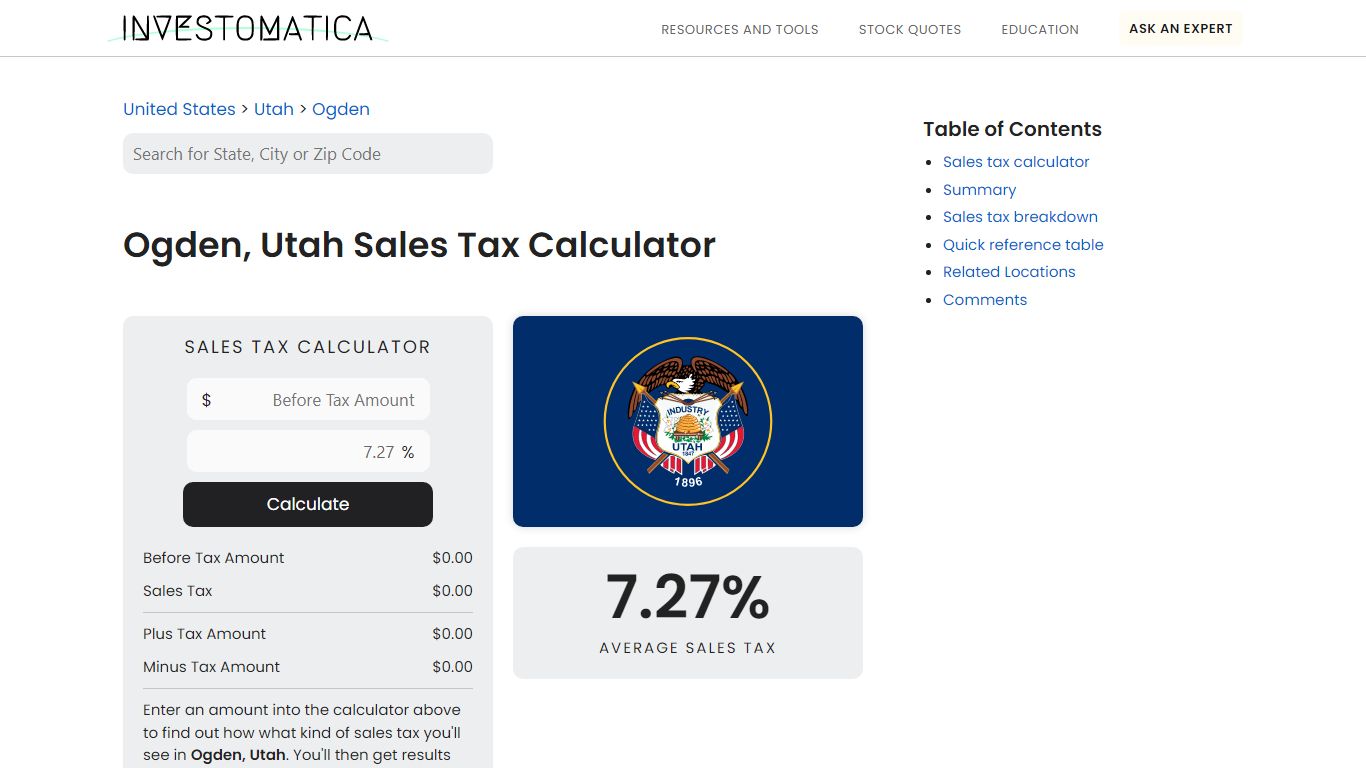

Ogden, Utah Sales Tax Calculator (2022) - Investomatica

Ogden, Utah Sales Tax Calculator Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Ogden, Utah. You'll then get results that can help provide you a better idea of what to expect. 7.27% Average Sales Tax Summary

https://investomatica.com/sales-tax/united-states/utah/ogden

Taxes & Fees - Utah DMV

See Utah Sales & Use Tax Rates to find your local sales tax rate. Multiply the rate by the purchase price to calculate the sales tax amount. Note that sales tax due may be adjusted, and payment will be required if the amount entered is incorrect and not verified. Corridor Fee Utah Code §41-1a-1222

https://dmv.utah.gov/taxes-fees